Medicare Supplement Plan C is comprehensive coverage, covering nearly all the gaps in Medicare, the only exception being Part B excess charges. Medigap Plan C is popular in states like Connecticut because excess charges aren’t allowed.

To be eligible for Plan C, you must have been eligible for the federal Medicare program before January 1, 2020.

Medicare Supplement Plan C?

Like other Medicare Supplement insurance plans, Medigap Plan C helps cover some of Medicare’s out-of-pocket costs. Original Medicare leaves you responsible for paying.

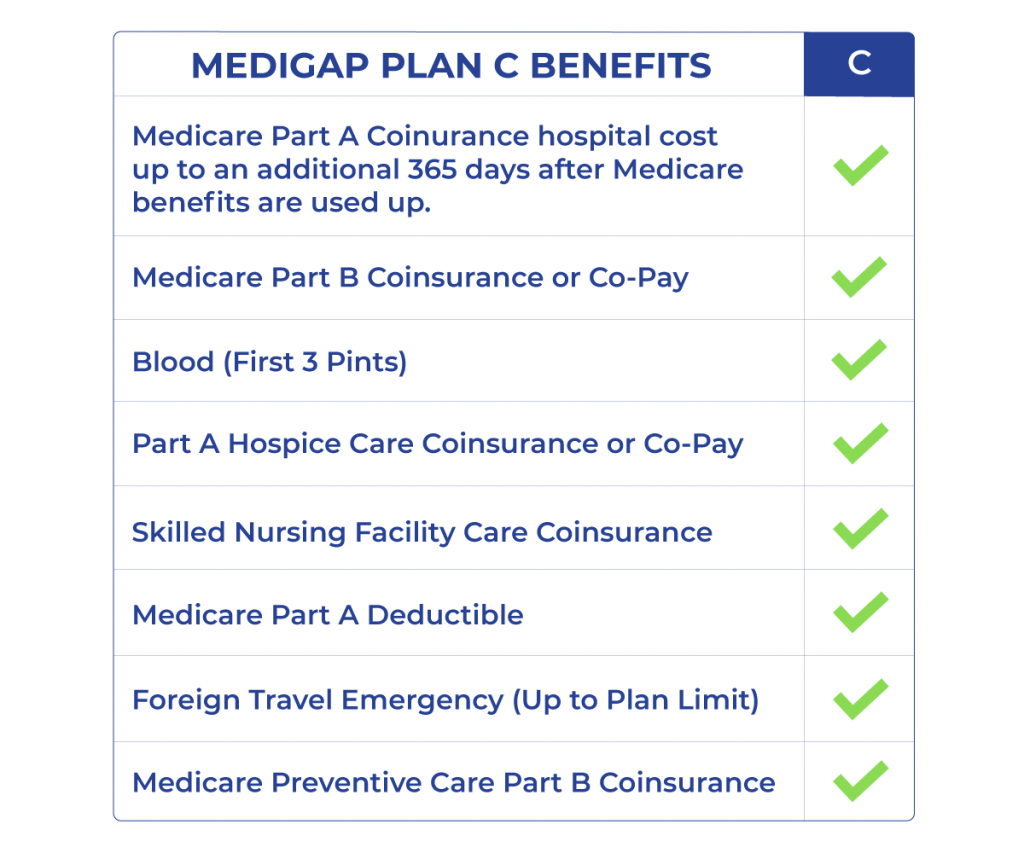

This Medicare Supplement plan option is popular because it covers many of the costs associated with Medicare coverage. We know Plan C doesn’t cover the excess charges, but let’s consider what the policy will cover.

Medicare Supplement Plan C coverage

Plan C will cover the Medicare Part A deductible and inpatient hospital coinsurance for up to 365 days after Medicare benefits are exhausted. Plan C covers the Part A Hospice care coinsurance or copayment.

The Skilled Nursing Facility care coinsurance has coverage. Also, the Part A and Medicare Part B deductibles are both covered by this policy. Medigap Plan C also includes coverage for Part B preventative care coinsurance.

The policy will cover the Part B coinsurance or copayment. Also, Plan C covers the first 3 pints of blood in a calendar year.

Foreign travel emergency coverage is up to the plan’s limits if you travel internationally.

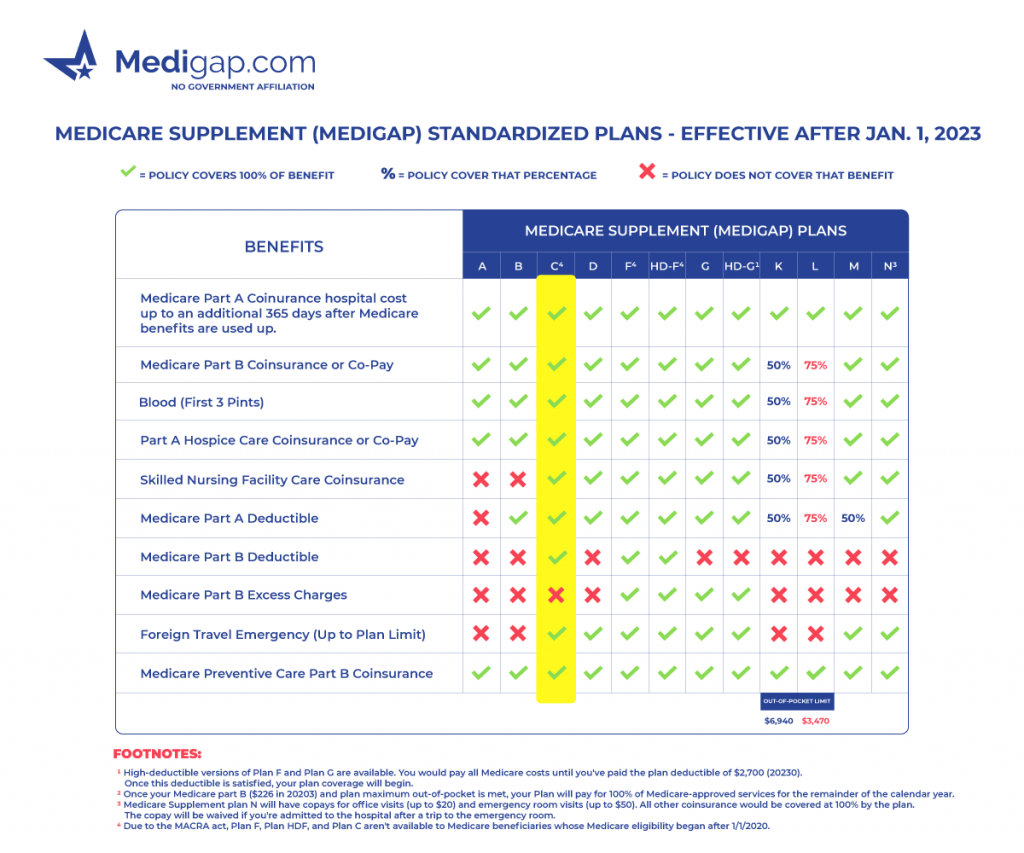

Medicare Supplement Plan chart

Medicare Supplement Plan C eligibility

Suppose you have Original Medicare Part B and were Medicare eligible before 2020. In that case, you’re eligible to enroll in Plan C. Those not eligible for Medicare until after 2020 can’t enroll in this plan.

If you’re not eligible for Plan C, other plans to consider would be Plan G or Plan N.

Medigap Plan C Premium costs

Medicare Supplement Plan C could cost somewhere between $120 to $220 monthly. But the cost of a Medicare Supplement health insurance policy varies depending on many factors.

If the monthly premium is a concern, consider comparing quotes with one of our licensed Medicare experts. They can help you identify the most valuable policy for your situation.

Medigap Plan C vs. Medicare Part C

Medigap Plan C is not a Medicare Part C, and these two policies are very different. Medicare Supplement plans are insurance that’s combined with Medicare. Part C Medicare Advantage plans are an alternative to Medicare.

Medicare Supplement insurance doesn’t include drug coverage; Part C Medicare Advantage plans sometimes include Part D prescription drug coverage. The out-of-pocket expenses can be much higher with a Medicare Advantage plan.

Medicare Advantage plans are costly if something catastrophic happens to your health and are usually network-based HMO or PPO plans.

Medigap plans allow you to go to any doctor that accepts Medicare. Part C plans require you to stay in-network in most cases.

Who should choose Plan C?

You should consider Plan C if you frequently travel, require specialist or doctor visits regularly, or have a fixed budget.

Plan C provides you with emergency foreign travel coverage. The plan lets you see any doctor or specialist that accepts Medicare with no copayments. And the premium is a predictable amount- instead of paying for services as you need them.

Medicare Supplement Plan C reviews

Medigap Plan C is one of the most popular plans in states without Part B excess charges. Covering these excess charges is the only thing differentiating Plan C from Plan F. This plan will cover all other costs associated with Original Medicare.

Plan C is discontinued for new Medicare beneficiaries.

FAQs

Can I still enroll in Medicare Supplement Plan C?

Yes, Plan C isn’t available for those newly eligible for Medicare. Those eligible before 2020 can still enroll in Plan C.

What is the difference between Medicare Supplement Plan F and Plan C?

Supplement Plan F and Plan C are almost the same plans. They have only one difference; Medicare Supplement Plan C doesn’t cover the Medicare Part B excess charges.

What are Medicare Part B excess charges?

Medicare Part B has excess charges that providers can charge above the Medicare-approved amount. Most healthcare providers don’t apply these charges, which are very easy to avoid.

When’s the best time to enroll in Medicare Supplement Plan C?

Most Medicare beneficiaries consider their Open Enrollment Period the best time to enroll in a Medicare Supplement Plan C. This period starts when you first start Medicare Part B and lasts six months.

How to get a quote for Medicare Supplement Plan C

Even though Plan C is no longer available for newly eligible beneficiaries, companies are still offering this policy nationwide. Many of the companies offering this insurance are companies that may have provided you with employer group coverage.

Yet, there may be lesser-known, top-rated carriers that can provide you with stable Medigap insurance.

Working with a Medicare specialist can save you time and money. Call us today at the number above to compare prices on Medigap Plan C with different insurance companies.

Quotes can be given over the phone and only take a few minutes. You can also fill out an online rate form to get started now.