As you age, you might suffer an ailment requiring time in a skilled nursing facility (SNF). Skilled nursing facilities are any medical facility where doctors, pathologists, physical therapists, and medically trained nurses are all required to give you the care you need to improve.

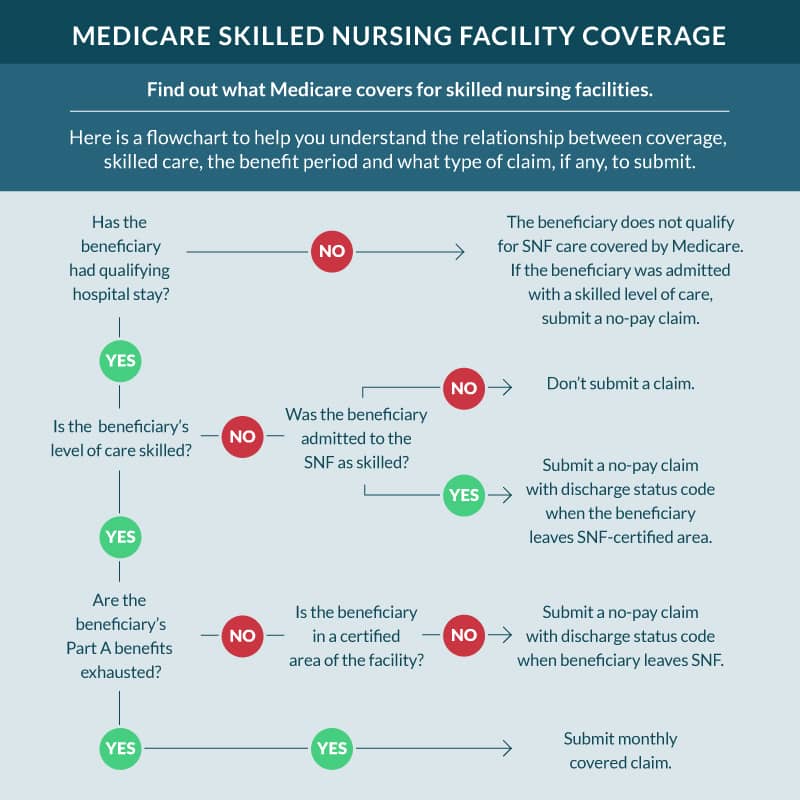

But you must coordinate with medical providers at a hospital first to get the okay from Medicare to stay in one of these facilities — unless you’re willing to pay 100% out-of-pocket. On top of that, your Medicare benefits will only pay for a limited stay in an SNF. This limited window in which you are eligible for benefits is called a “benefit period.”

The good news is that you can be eligible for more than one benefit period per year, but it can still get expensive if you aren’t careful. Below is the rundown on how benefits periods work for skilled nursing facilities.

We’ll explain how you can get the most out of your Medicare benefits and what you must do to protect yourself from exorbitant out-of-pocket costs.

How skilled nursing facilities benefit periods work

The benefit period for staying in an SNF facility covers the first 100 consecutive days (or less) you require that specific specialized care. During your benefit period, Medicare will pay for most of your costs depending on how long you stay in the facility. But once your benefit period runs out, you’re on your own.

First 3 days

You must get checked into a Medicare-qualified hospital and receive at least three days of qualifying medical care before checking into the SNF. You must receive an official medical discharge from your doctor that explicitly states that you need SNF care, and they must discharge you to a Medicare-certified SNF facility to file a claim. This is also known as the “3-day rule”

Next 20 days

For the first 20 days of your benefit period, Medicare will pay for the full cost of SNF care with zero out-of-pocket costs for you

Next 80 days

After the first 20 days, you’ll have an additional 80 days of subsidized SNF care. However, you’ll have to pay $194.50 per day out-of-pocket without a Medicare Supplement plan. That’s over $15,560 for the entire out-of-pocket benefit period if you rely on Medicare for your healthcare coverage alone. This is also known as the “100-day rule”

After your 100 days are exhausted, you’ll have to pay 100% out-of-pocket or get medically discharged from the facility for 60 consecutive days. After that, if necessary, you can start a brand new benefit period by following all the steps described above.

The types of care that skilled nursing facilities provide

SNFs are a unique type of facility that aren’t quite hospitals but help patients with medical needs that can’t be met with outpatient therapy.

You must get approval from a qualified medical professional (like a speech and language pathologist, a licensed practical nurse, or a physical/occupational therapist) who agrees that you require this specific level of care.

Medical conditions where skilled nursing facilities care is necessary

After a stroke

Depending on the stroke’s severity, you may require around-the-clock care to meet your personal hygiene needs. You should watch for multiple strokes, neurological recovery, physical rehabilitation, or occupational speech therapy.

After a traumatic brain injury (TBI)

If you get into a car accident or fall and hit your head, you may need to be kept under observation for several weeks or months to manage the condition. It’s not uncommon for TBIs to require the same types of care that help stroke victims recover from their injuries.

After one or more severe skeletal fractures

As you age, your decreased mobility and bone density put you at risk for severe fractures from slips, trips, and falls. These injuries take longer to heal in older citizens and require more intense physical rehab than most fractures.

Hospice care

Some provisions in your Part A benefits will cover SNF hospice care, provided it is a Medicare-certified hospice facility. But you will have to pay for your room and board out-of-pocket.

These are a few examples of why a Medicare recipient might require SNF care. But these injuries/diseases can be debilitating or life-threatening without proper care in a skilled nursing facility.

You shouldn’t hesitate to take advantage of your Medicare benefits and seek this care if your doctor agrees you need it.

But if you need extended SNF care, you should try to plan and ensure you have supplemental coverage to help with copays and out-of-pocket costs.

Medicare Supplement insurance for skilled nursing facilities

Remember the tens of thousands of dollars in out-of-pocket costs we mentioned earlier for those that need to spend more than 20 days in a skilled nursing facility? You could virtually eliminate those costs with the right Medicare Supplement plan.

All ten plans offer to pay for 100% of your Part A Medicare coinsurance and hospital costs for 365 days after your Medicare Part A benefits run out. But beware: that doesn’t necessarily apply to SNF care.

There are special benefits specifically for SNF care which Medigap insurance plans cover. Only Medigap Plans C, D, F, G, K, L, M, and N cover SNF coinsurance costs; Plans A and B do not.

Furthermore, two plans — K and L — don’t cover 100% of those costs. Plan K only covers 50% of your coinsurance costs after day 20, while Plan L covers a more generous 75%.

Alternatively, you can find a good Medicare Advantage plan that provides benefits for SNF coinsurance costs after your Medicare Part A benefits run out.

But your cost-share responsibility and the number of days your insurance provider will pay for are something you have to negotiate personally with your insurance agent.

FAQs

Can Medicare kick you out of rehab?

Often, it’s the facility’s choice whether or not to expel a patient from their care, not Medicare itself. But if Medicare doesn’t pay a claim and you don’t have the money, the facility may choose to discharge you.

That’s why supplemental coverage is so important so that your care doesn’t face interruption by such setbacks.

What is the Rehab 60% Rule?

The rehab 60% rule largely applies to inpatient rehabilitation facilities (IRFs) rather than SNF care. Because IRFs are more intense — and usually more expensive — than SNF care, to cut costs, there’s an old rule which stipulates that at least 60% of an IRF’s patients must be getting treatment for at least one of 13 specific conditions.

When the percentage falls under 60%, whoever isn’t getting treatment for one of those 13 conditions faces discharge from the facility.

How long will Medicare pay for rehab in a nursing home?

Certain SNF facilities would discontinue care for those who’ve seen their health improvement “plateau”, even if they still required medical care.

The CMS office clarified in 2014 that this wasn’t an enforceable practice anymore; older facilities haven’t caught up on these changes, and they may try to discharge patients for fear of Medicare rejecting claims.

So caregivers and beneficiaries in more rural areas may have to work a little harder at patient advocacy. This is to make sure they get the care they deserve.

Getting Medicare coverage that fits you

It’s not uncommon for Medicare beneficiaries to wonder if they’ll have coverage if they need a skilled nursing facility.

If anything, seeing how Medicare coverage for skilled nursing facilities works emphasizes the need for supplemental coverage. This will help you avoid the gaps in your coverage.

To that end, our licensed insurance agents are available to help you with any questions. They can also pair you with the right supplemental plan for your unique needs. This is free of cost to everyone, so there’s no reason not to contact us.

So give us a call or fill out our online rate form today so we can look for the best rates and plans in your area.

Related Content