Virginia Medicare Supplement plans are the perfect choice for Virginians who want complete protection in any situation. With all 12 Medicare Supplement policies available, there’s a plan that will fit your needs and budget.

Below, we will cover the most critical information about you as a Medicare beneficiary. This information includes how many enrollees are in each letter plan and their average premium for this specific coverage type with each carrier’s offerings throughout Virginia.

Virginia Medicare Supplement plans for 2024

The number of Medicare beneficiaries enrolled in a Medigap plan in Virginia has increased, with 429,851 Medicare members enrolled. Measure that out to around 33.5% of all Medicare beneficiaries covered by a Medigap plan, and you’ll see just how important they can be for those who need them!

| Plan | A | B | C | D | F | G | K | L | M | N |

| Enrollees | 2,522 | 2,788 | 7,448 | 1,086 | 259,379 | 90,245 | 1,877 | 807 | 13 | 32,083 |

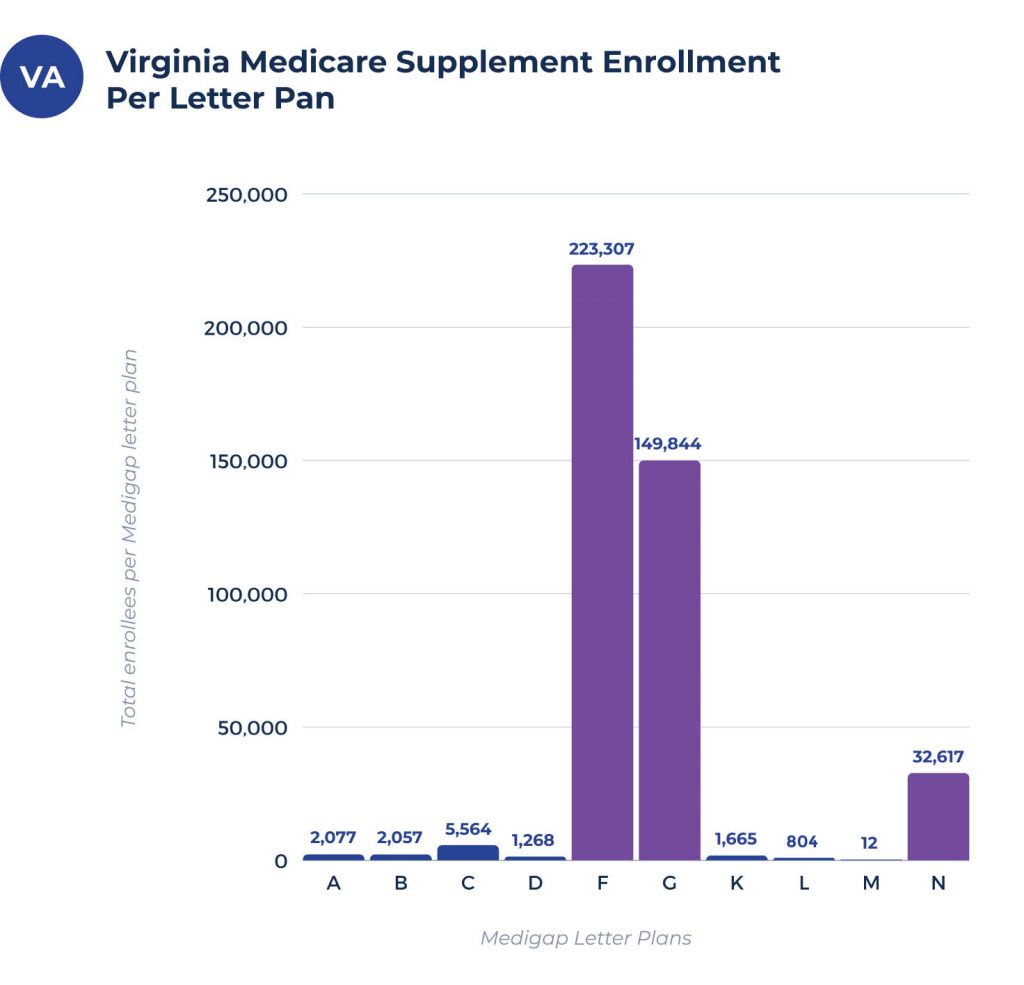

Most common Medigap plans in Virginia

The most popular Medigap plans that Virginia residents choose to enroll in are shown in the chart above. Plan F, Plan G, and Plan N are among the most popular policies.

Medicare Supplement plan coverage chart for Virginia

The federal government standardizes Medigap plans, so there’s no need to worry about state-specific coverage. Even if you live in a different state, your benefits will remain identical with each letter plan across almost all 50 states. The states with alternative plan options are Wisconsin, Minnesota, and Massachusetts.

Medigap plan cost in Virginia

Knowing that many factors can impact your monthly premium for Medicare Supplement plans is essential. Even though the benefits won’t change across each state, you may pay more or less depending on where in Virginia you reside!

What’s the average cost for a Medicare Supplement plan in Virginia?

Virginia Medicare Supplement plan premiums vary based on a few factors. The average monthly premium is between $69 to $160.

Lowest premium per Medigap letter plan in Virginia

The following examples are sample costs for a 65-year-old woman living in Richmond, Virginia.

| Plan | A | B | C | D | F | G | K | L | M | N |

| Premium | $84 | $104 | $124 | $184 | $116 | $92 | $47 | $80 | $161 | $69 |

Top Medigap carriers in Virginia

We’ll use the same criteria above to evaluate the leading Medigap carriers and their premiums for letter plans below.

| Carriers | Plan F | Plan G | Plan N |

| The Capitol Life Insurance Company | $116 | $92 | $69 |

| Accendo Insurance Company | $122 | $103 | $77 |

| Cigna Health And Life Insurance Company | $129 | $111 | $81 |

| Mutual Of Omaha Insurance Company | $132 | $104 | $79 |

| Medicare Supplement Plans, Insured By | $143 | $110 | $95 |

Which Medicare Supplement plan in Virginia is right for me

There is no such thing as a one-size-fits-all solution. The ideal plan is most likely not the same as those around you.

Suppose you’d rather spend less on monthly premiums while still getting good coverage. A high deductible policy such as the HDF or HDG could better suit your needs.

Another factor to consider is when you became eligible for Medicare. If you can’t join Plan F because you’re now just qualifying.

Because this letter plan is no longer an option, think about choosing Plan G as the nearest letter plan because that’s the closest letter plan to Plan F.

Cities in Virginia with estimated premiums for Medicare Supplement plans

Estimated premiums for each type of Medicare Supplement coverage for the cities listed below can be accessed with the accompanying charts linked below:

FAQs

Will my Medicare Supplement benefit increase as I get older in Virginia?

Yes, all Medigap plans will rise in cost. Most plans in Virginia are age-attained, which means they will increase based on age and other criteria, such as inflation.

What is the typical cost of Medigap Plans in Virginia?

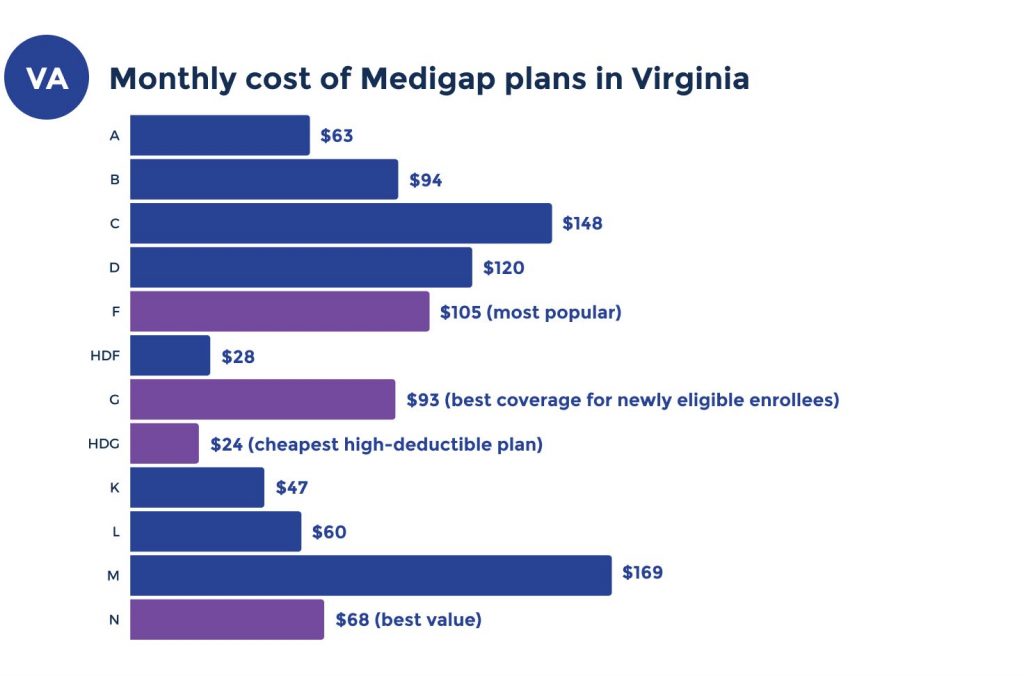

The price of Medigap plans varies based on the provider and policy. Plan Averages are listed below:

- Plan F is about $129

- Plan G is around $104

- Plan N averages $81

What is the most popular Medigap Plan in Virginia?

Plan F is the most popular Medicare Supplement insurance plan in Virginia.

How to get help enrolling in a Medigap plan in Virginia

There are many different carriers to compare, and it can take a lot of time and effort to do it yourself. That’s where a professional licensed insurance agent can assist.

Our agents work with all carriers to ensure you get the most advantageous plans while spending the least money possible.

We can assist you whether you’re ready to sign up for a Medigap policy or look at alternatives such as Medicare Advantage assistance. To view rates now, fill out our rate form or call us.