Your Medicare Supplements work differently than the standard Medicare model if you live in Minnesota. You’ll begin with a base plan and add-on plan riders.

Medigap insurance plans will assist you in avoiding high out-of-pocket medical costs. Enrolling in one of these plans provides certain medical expenses.

When moving into Medicare, picking the right supplement for your condition is critical. We’ll explain how Minnesota’s plans operate.

Minnesota Medicare Supplement plans

Minnesota has 118,594 Medigap Plan members, around 24.8% of all Medicare participants.

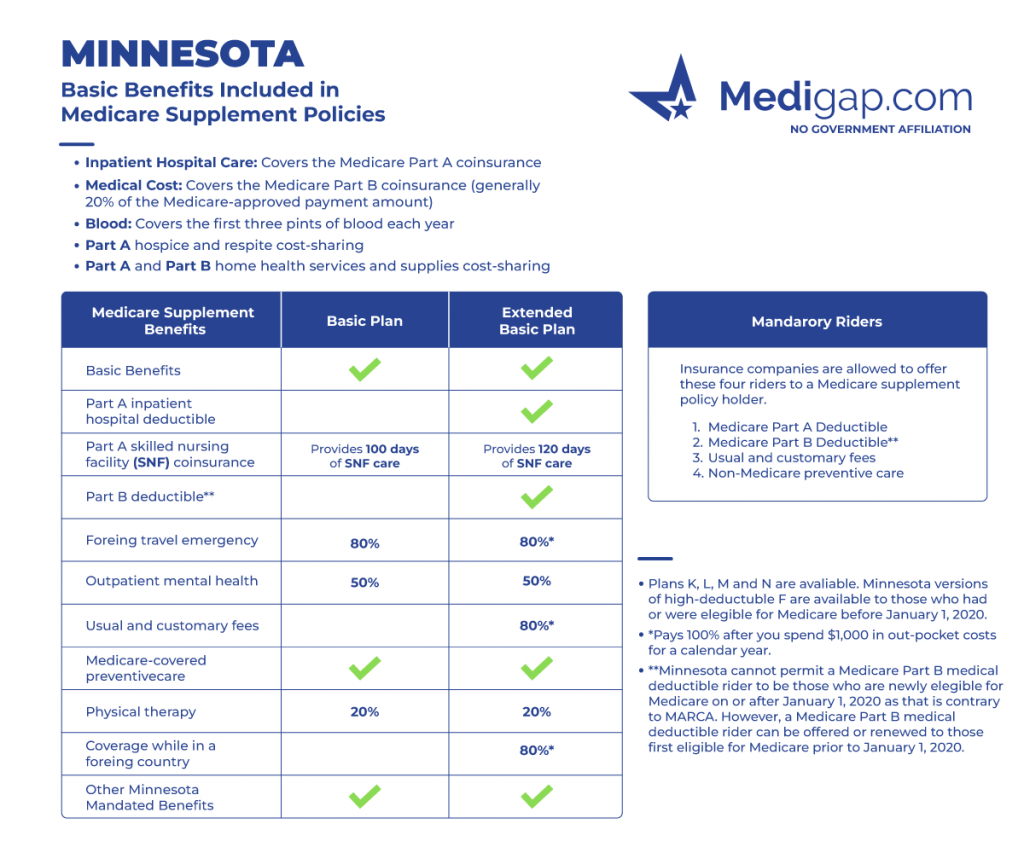

Medicare Supplement coverage chart in Minnesota

Regulated by the federal government, Medigap plans from state to state have the same coverage. This is true in every other state outside Wisconsin, Minnesota, and Massachusetts. Regardless of where you live, your benefits will not change. We’ll demonstrate how Minnesota’s rider system works below.

In Minnesota, you begin with a basic plan, add riders for the coverages you want, and choose the Extended Basic plan or the PBCO.

The PBCO is Minnesota’s version of Plan N. The Basic plan is the starting point and is similar to Plan A.

Basic Plan

- Part A coinsurance begins after 60 days of inpatient care

- Skilled Nursing Facilities (100 Days)

- Hospice

- First 3 pints of blood

- Part B Coinsurance

- Outpatient Mental Health at 50%

- Physical Therapy at 20%

- 80% of a foreign travel emergency

- Medicare Covered preventative care

- State-mandated benefits (diabetic equipment and supplies, routine cancer screening, reconstructive surgery, and immunizations)

Doesn’t Cover

- Part A: inpatient hospital deductible

- Usual and customary fees

- Part B: deductible

If you enroll in the Basic plan, you add riders to customize coverage.

Additional Riders for the Basic Plan

- Part A: inpatient hospital deductible

- Non-Medicare preventive care

- Part B: deductible (only available to beneficiaries on Medicare before January 1, 2020)

- Usual and customary fees

Each rider has a cost that will either add or subtract from the base cost of the basic plan.

Extended Basic

- Part A coinsurance begins after 60 days of inpatient care.

- Hospice

- Part A: inpatient hospital deductible

- First 3 pints of blood

- Part A: skilled nursing facility (SNF) coinsurance (provides 120 days of SNF care)

- 80% of a foreign travel emergency

- Part B: deductible (only available to beneficiaries on Medicare before January 1, 2020)

- 50% of outpatient mental health

- 80% of usual and customary fees (plan pays 100% after you spend $1,000 in out-of-pocket costs for a calendar year)

- Medicare-covered preventive care

- 20% of physical therapy

- 80% of coverage while in a foreign country

- State-mandated benefits (diabetic equipment and supplies, routine cancer screening, reconstructive surgery, and immunizations)

Minnesota Medicare Supplement Plans K, L, M, and N versions are available. People covered by Medicare before January 1, 2020, can get Minnesota high-deductible F plans.

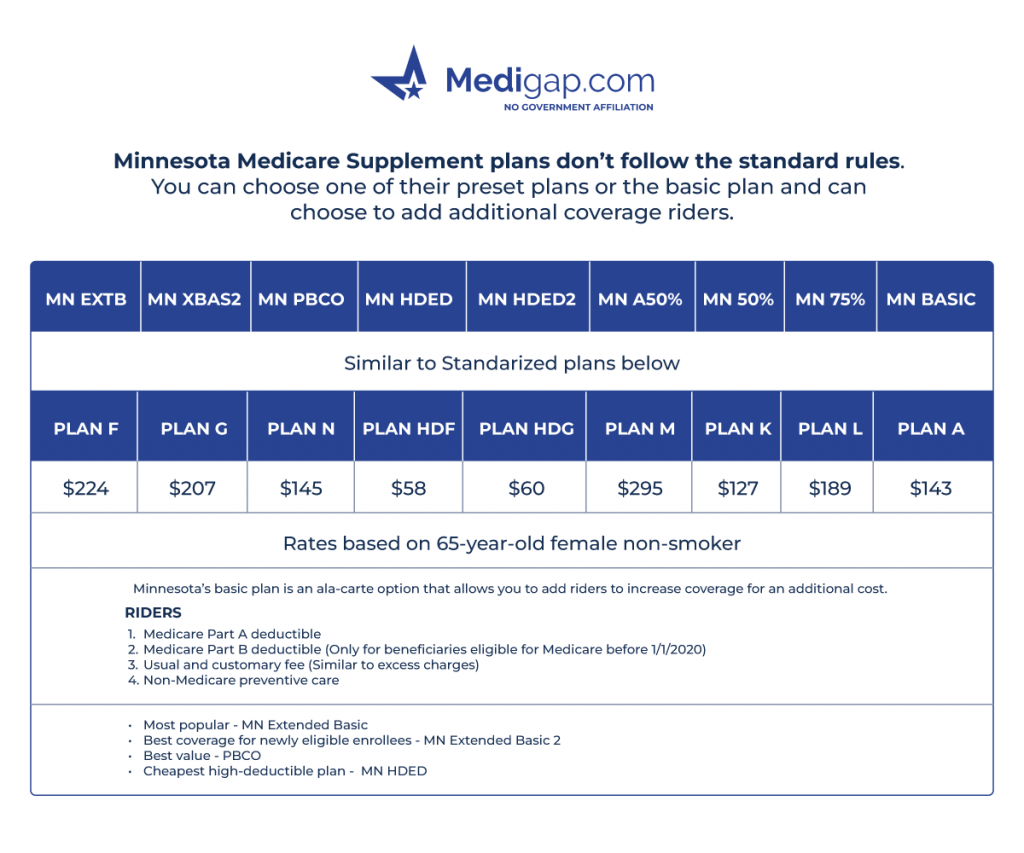

What’s the average cost for a Medicare Supplement Plan in Minnesota?

The cost of a Medicare Supplement plan in Minnesota varies according to your add-ons and programs. The monthly premium might be anything from $160 to $459.

Medigap costs in Minnesota

The cost of Medigap insurance varies depending on a variety of factors. Your health, age, and life region may all impact your plan costs.

Open enrollment for Medigap is not a yearly occurrence, and it’s a one-time enrollment that applies only to the beneficiary in question. You can select any plan or company during your one-time six-month Open Enrollment Period. In addition, you will not have to qualify medically.

Lowest Medicare Supplement premiums in Minnesota

Based on the most common rider combinations, the least expensive Medigap plans in Minnesota are:

- Minnesota’s Version of Plan N (PBCO) = $161

- Base+Part A Deductible = $167

- Extended Basic (EXTB) = $217

Most popular Medicare Supplement plan riders

Most beneficiaries in Minnesota that choose the Basic plan will add only the Part A deductible rider since doctors in Minnesota don’t charge Part B excess charges.

If the beneficiary travels, they would also add the usual and customary rates rider to their basic plan to cover excess charges when traveling to states with excess charges.

Plan PBCO is the most popular plan in Minnesota, with low premiums and affordable copays. Plan PBCO is Minnesota’s version of Plan N.

The Extended Basic is very popular since it’s less expensive than the Basic plan, with all riders covered. It covers all benefits the Basic provides for all riders and allows more coverage for skilled nursing care.

Top Medicare Supplement carriers in Minnesota

We’re using a 65-year-old woman from Saint Paul as our reference in the example below. Most state carriers utilize community age rating systems.

| Carriers | PBCO | EXTB | Basic+A Rider |

| Continental Life Insurance Company (Aetna) | $161 | $217 | $254 |

| Cigna Health And Life Insurance Company | $160 | $248 | $209 |

| Medicare Supplement Plans, Insured By | N/A | $257 | $227 |

| Americo / Great Southern Life Insurance Company | $172 | $280 | $198 |

| Humana Insurance Company | $290 | $459 | $355 |

What is the best Medigap plan in MN for me?

Each person’s needs are different, but it might be challenging to determine which Medicare Supplement is ideal for you.

Even though all Medigap plans and carriers give identical coverage, some people may find one more appealing than others. Some Medigap suppliers have improved client care, faster claims settlement, and other valuable features.

You should also address your long-term medical care requirements. We’ren’t fortune tellers, but family history may assist us in approaching the bull’s eye. Being honest about how well you expect your health to perform as you age is critical.

Future changes in insurance companies will be based on whether or not you can pass underwriting.

While the cost is critical, you don’t want to spend too much on similar protection. Pick well-known and financially stable firms for the best experience.

When selecting, consider all these aspects to obtain an outstanding client service provider.

Cities in Minnesota with Medicare Supplement plans’ estimated premiums

Below, we have created handy charts to show you sample rates of Medigap plans in Minnesota for the following cities:

FAQs

What’s the most popular Medigap plan in MN?

The most popular Medigap plan in Minnesota is the PBCO. The PBCO is Minnesota’s version of Plan N.

What’s the average cost for a Medicare Supplement Plan in Minnesota?

The cost of a Medicare Supplement plan in Minnesota varies according to your add-ons and programs. The monthly premium might be anything from $160 to $459.

Are Medicare Supplement plans expensive in Minnesota?

Minnesota’s Medigap plans start at about $160. The monthly cost of your policy is determined by the plan and any extra riders you select. Age, tobacco usage, and additional factors can also affect your premium.

How to get help with Medigap plans in Minnesota

Now that you’re armed with more information, getting a Medigap plan must seem like the right call. Minnesota residents can receive free help by talking to our licensed insurance agents.

Our agents work with many companies and can pair you with the right Medicare Supplemental plan for your unique needs.

Call them today, or fill out our easy and quick online rate form to get the best rates in your zip code.