The upcoming Medicaid coverage redetermination process has generated much interest and anxiety among Americans.

With the proposed changes, millions of low-income individuals and families could lose healthcare benefits, significantly impacting their lives.

The potential loss of coverage could devastate vulnerable groups, such as the elderly, children, pregnant women, and people with disabilities.

Additionally, the proposed changes could cause a ripple effect on Medicare plans, healthcare providers, and the economy, as they may see a decrease in revenue and an increased burden on emergency services.

What is Medicaid Redetermination?

Medicaid redetermination is reviewing a recipient’s eligibility for Medicaid benefits. This occurs periodically, typically once a year, to ensure that individuals are still eligible for their benefits.

The redetermination process involves collecting information on income, assets, and other factors affecting a recipient’s eligibility.

It’s an essential step in maintaining the integrity of the Medicaid program and ensuring that benefits are only provided to genuinely eligible people.

For recipients, responding to redetermination requests promptly and providing accurate information is important to avoid any benefits interruptions.

Medicaid redetermination helps ensure that the program remains sustainable and continues to provide critical healthcare coverage to those who need it most.

What information is collected in Medicaid redetermination?

- Income

- Assets

- Household size

Who will the Medicaid redetermination in 2023 affect the most?

The upcoming Medicaid redetermination process will significantly impact many individuals who rely on this program as their primary healthcare means.

This process will particularly affect low-income families and individuals, elderly populations, and people with disabilities.

These Americans are disproportionately vulnerable to changes in Medicaid eligibility requirements due to their financial and health-related challenges.

The redetermination process will require individuals to provide updated information on their income, household size, and other factors determining their Medicaid eligibility.

This could result in some losing access to essential healthcare services.

Policymakers must carefully consider the potential impact of this process on these vulnerable populations and take necessary measures to ensure that they are not left without access to vital healthcare services.

While many Medicare beneficiaries will not lose their Medicaid eligibility because they will still be under the Medicaid income and asset guidelines, the most affected individuals will be low-income families.

Who’s affected?

- Elderly Americans

- Children

- Low-income individuals and families

- Individuals with disabilities

How many individuals will lose Medicaid due to the unwinding provisions

The potential number of Medicaid enrollees who may face disenrollment during the unwinding period can’t be precisely determined.

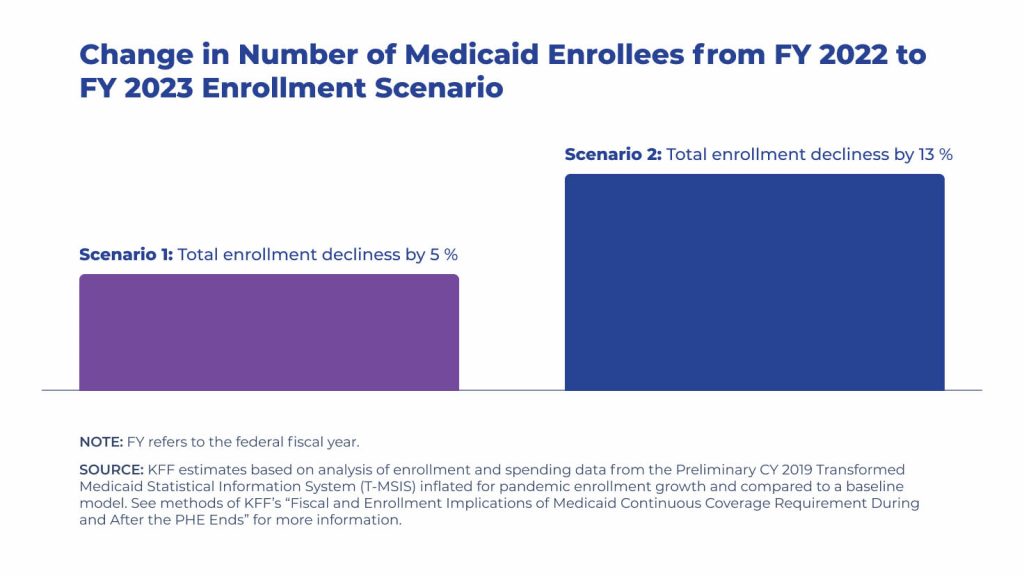

However, current estimates suggest that between 5.3 million to 14.2 million individuals may experience a decline in Medicaid coverage, resulting in a 5% to 13% drop in enrollment over the 12 months.

These projected coverage losses align with the previous estimates by the Department of Health and Human Services, indicating that approximately 15 million individuals may experience disenrollment, including 6.8 million who are still likely eligible.

What makes this Medicaid redetermination different from previous years?

Amidst the COVID-19 pandemic, Congress implemented the Families First Coronavirus Response Act (FFCRA), which included a provision requiring Medicaid programs to maintain uninterrupted enrollment of individuals until the end of the public health emergency.

This provision was incentivized through federal funding enhancements.

COVID-19 impacts on Medicaid redetermination

However, with the recent implementation of the Consolidated Appropriations Act in 2022, the requirement of continuous enrollment is no longer tied to the public health emergency.

As a result, this provision will expire on March 31, 2023.

The Consolidated Appropriations Act (CAA) provides for a gradual reduction of the increased federal Medicaid matching funds until December 2023.

The continuous enrollment provision has been a crucial factor in increasing Medicaid enrollment and reducing the number of uninsured individuals during the pandemic.

However, with the expiration of the continuous enrollment provision, states are preparing to terminate enrollees, which poses a significant risk of millions losing access to healthcare, potentially undoing the progress achieved thus far.

States can initiate disenrollments as of April, but they must meet specific criteria to qualify for enhanced federal financing during the unwinding phase.

Families First Coronavirus Response Act (FFCRA) impact on the Medicaid redetermination

Congress enacted the FFCRA to pause the redetermination of Medicaid until the end of the COVID-19 public health emergency.

This allowed many Americans to remain on Medicaid that otherwise wouldn’t have been re-qualified.

Consolidated Appropriations Act of 2023 (CAA) and Medicaid redetermination

Congress signed the CAA into law on December 29, 2022. It removed the continuous Medicaid enrollment portion from the public health emergency to allow states to resume disenrollments from Medicaid as of March 31, 2023.

States must comply with specific regulations to be eligible for the gradual reduction in the enhanced Federal Medical Assistance Percentage (FMAP).

These regulations prohibit states from restricting eligibility standards, methodologies, or procedures and raising premiums as mandated in the Families First Coronavirus Response Act.

Furthermore, states must adhere to federal guidelines for the renewal process and ensure that contact information for enrollees is accurate and up-to-date.

States must also make reasonable efforts to notify enrollees before disenrollment in the event of returned mail.

What options do I have if I lose coverage due to Medicaid redetermination?

Should you become ineligible for Medicaid due to reassessments, alternative options are available for securing economically feasible coverage.

These options include subsidized plans offered through the ACA Marketplace, employer-provided plans, or Medicare. Exploring these options is advisable to ensure you maintain adequate healthcare coverage.

Coverage options when losing Medicaid coverage

There are several coverage options available to individuals that lose Medicaid. Losing coverage triggers special enrollment periods, allowing people to enroll in other health insurance.

Alternative coverage options for individuals losing Medicaid

- Medicare Advantage

- Medicare Part D

- Medicare Supplement

- Affordable Care Act – Marketplace plans

- Employer group coverage – Spousal employer coverage

Medicaid Statistics

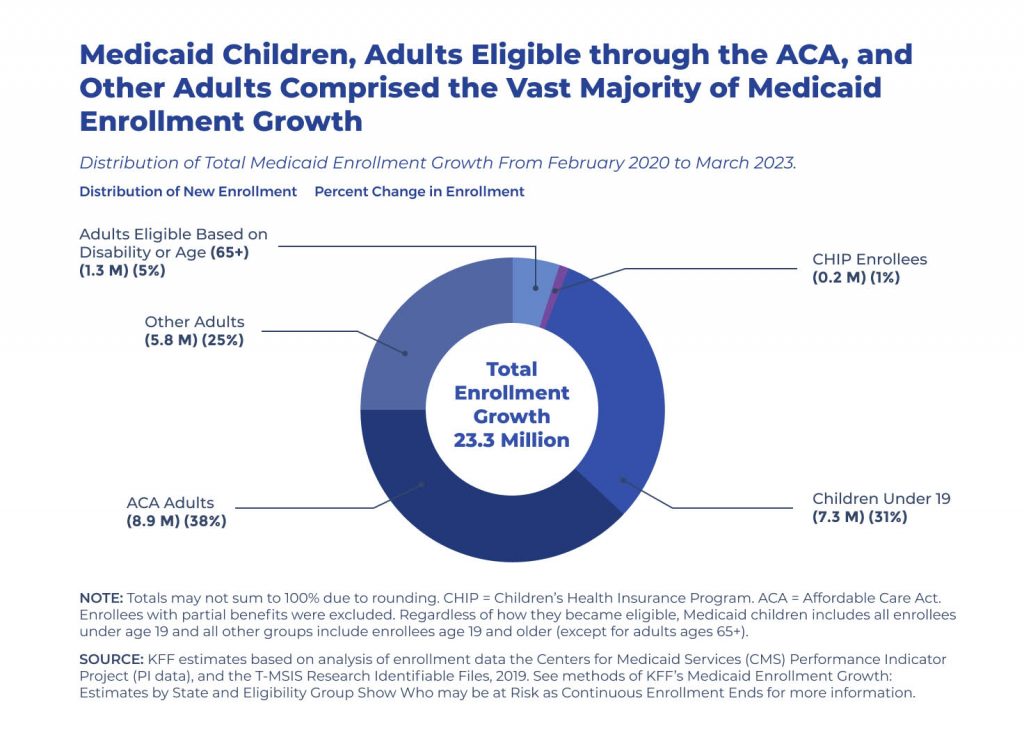

From February 2020 to the end of March 2023, there has been a significant increase in Medicaid/CHIP enrollment, with a growth of 23.3 million individuals, bringing the total number to almost 95 million.

This substantial rise in enrollment can be attributed to a range of factors, including the economic impact of the pandemic, the implementation of Medicaid expansion in certain states (NE, MO, OK), and the inclusion of the continuous enrollment provision in the FFCRA.

The continuous enrollment provision mandates that states maintain continuous coverage for Medicaid enrollees to receive increased federal funding.

This has not only helped to preserve coverage during these unprecedented times but also increased state spending for Medicaid.

However, it is worth noting that the KFF has estimated that the enhanced federal funding, which results from a 6.2 percentage point increase in the federal match rate (FMAP), has offset the higher state costs.

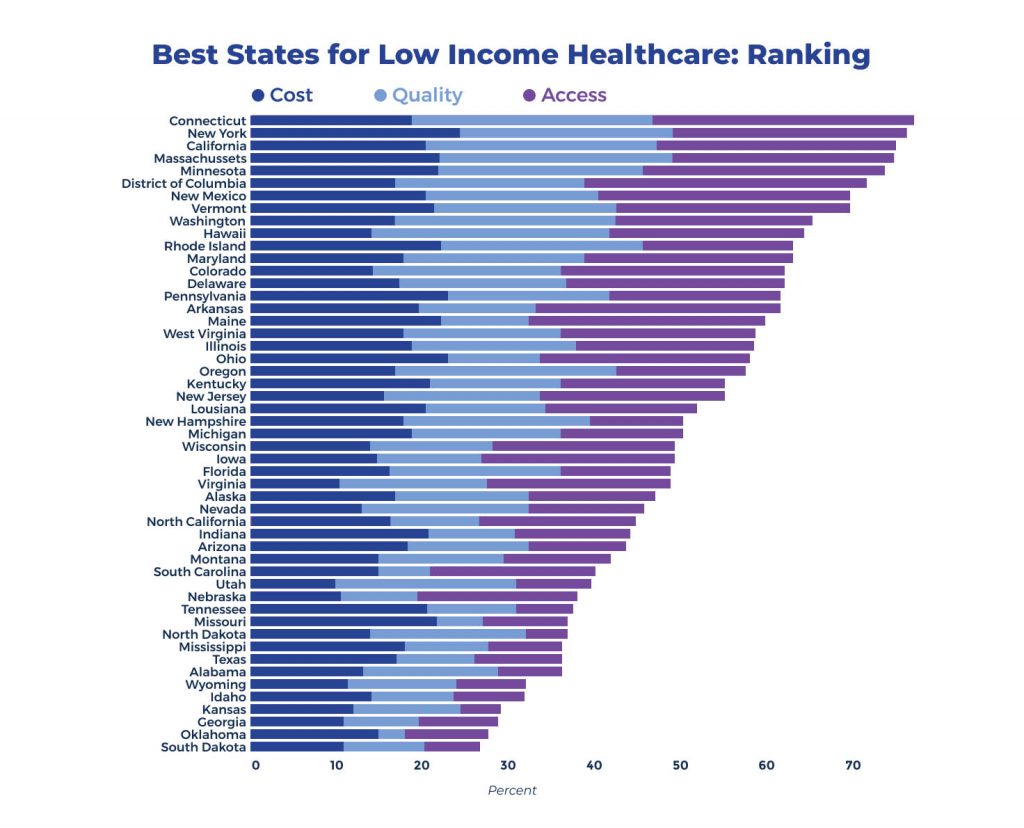

What State has the best Medicaid program

Medicaid and the Children’s Health Insurance Program (CHIP) have been established through state and federal funding to offer health insurance coverage to individuals who are financially disadvantaged and lack appropriate resources to purchase it independently.

Notably, each state has distinct eligibility criteria and policies in place.

FAQ

What’s the highest income to qualify for Medicaid?

The criteria for determining parental eligibility are expressed as a proportion of the 2023 Federal Poverty Level (FPL) for a family of three, currently valued at $24,860.

Meanwhile, the standards for determining the eligibility of single adults with no dependents are measured as a percentage of the 2023 FPL for an individual, presently set at $14,580.

What states have the highest Medicaid income limits?

Alaska and Hawaii are two states in the United States that have distinct Federal Poverty Line (FPL) thresholds for individuals. The FPL for individuals in Hawaii is $14,380, while in Alaska, it is $15,600.

Washington, DC, has the highest income limits for both families and individuals. Therefore, if you reside in the Washington, D.C. area, a family of three can qualify for Medicaid if their income is 221% of the FPL.

What is the highest income to qualify for healthcare.gov?

Experts estimate that a household of four will earn between $27,750 and $111,000 in 2022. It’s important to note that Alaska and Hawaii may have higher income limits due to a greater federal poverty level.

The American Rescue Plan Act of 2021 expanded subsidy eligibility to individuals earning over 400% of the federal poverty level. This legislative action serves to increase accessibility to healthcare subsidies and support those in need.

Who uses Medicaid the most?

The demographic composition of Medicaid beneficiaries comprises children, elderly individuals, and those with disabilities. Children make up nearly half of all Medicaid beneficiaries, with over 35 million enrolled in the program.

Medicaid also serves as a safety net for elderly individuals, with over 9 million beneficiaries aged 65 and older enrolled in the program.

Additionally, Medicaid provides critical healthcare coverage for those with disabilities, with over 10 million beneficiaries enrolled in the program.

What are the biggest problems with Medicaid in the US?

Looking forward, Medicaid faces three critical issues requiring urgent attention in the year’s remaining months.

These challenges encompass the need for improved eligibility criteria and bolstered state supervision, the upcoming expiration of temporary coverage enacted in response to the pandemic, and the lack of widespread public support, which poses a significant barrier to advancement.

Although Medicaid will start a redetermination period again, it doesn’t mean affordable healthcare options exist. Reviewing healthcare options is easy. View online quotes and plans for Medicare or Marketplace plans in your area today!

Sources – Medigap.com extracted and analyzed data from the following to provide data in this article.

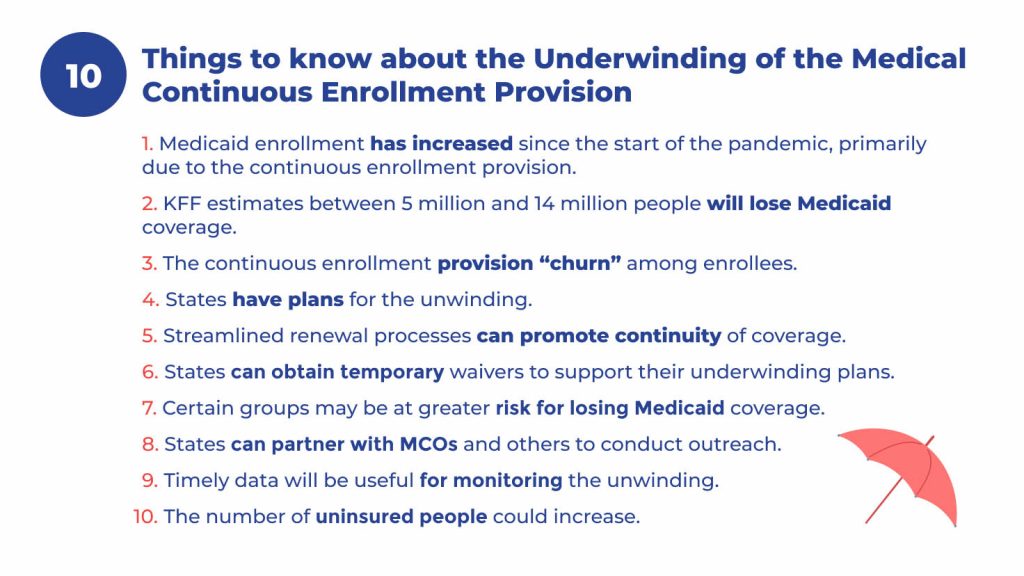

- “10 Things to Know About the Unwinding of the Medicaid Continuous Enrollment Provision” (Kaiser Family Foundation)

- “Federal Medical Assistance Percentages or Federal Financial Participation in State Assistance Expenditures (FMAP)” (Department of Health and Human Services)

- “What is Medicaid redetermination?” (HealthInsurance.gov)

Related Content

- Medicare vs Medicaid

- How Many Seniors Live in Poverty in the United States?

- Best Health Insurance Options for Seniors and Retirees

- How the Inflation Reduction Act of 2022 Will Impact Medicare

- Top 5 Government Benefits for Seniors Over 65

- 10 Tips for Frugal Retirement Living