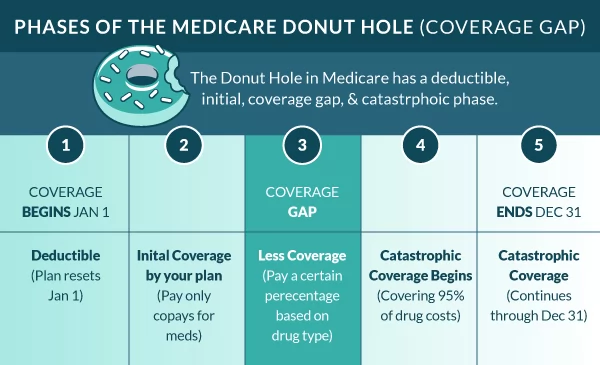

The donut hole is more formally known as the Medicare Part D coverage gap. During the prescription drug coverage gap, beneficiaries notice a higher cost in out-of-pocket expenses than in the other stages.

The coverage gap is intended to encourage beneficiaries to use less expensive generic drug alternatives, costing the Part D program less money.

What is the Donut Hole in Medicare?

The Medicare donut hole is a coverage gap in Part D prescription plans. The cost of medicine can be higher during this phase of coverage than during other stages of Part D coverage.

How Does the Medicare Part D Donut Hole Work?

After the deductible, you’ll enter the Initial Coverage phase. During the Initial Coverage phase, you pay copays for your prescriptions until the total cost of your medications reaches the threshold that puts you in the donut hole.

To get out of the donut hole, you’ll pay a certain percentage of your prescriptions until the total cost reaches the threshold that puts you in the Catastrophic Coverage phase through the end of the year.

What Costs Count Toward the Coverage Gap?

The total cost of medications counts towards entering and exiting the coverage gap. The total cost of your drugs includes the portion you pay for your prescriptions and the portion the plan pays for your medications.

When exiting the donut hole, the total cost of the drug includes what you, your plan, and the manufacturer pay. So, the manufacturer pays 70%, your plan pays 5% of the cost, and you pay 25%.

95% of the cost of the drug counts toward out-of-pocket spending. The total cost only applies to medications on your plan’s formulary.

Costs that don’t count toward the coverage gap include premiums and drugs that aren’t covered.

Do all Part D Plans Have a Donut Hole?

All Part D plans have a donut hole or coverage gap. The thing is, not everyone reaches the donut hole. Out of 45,000,000 Part D beneficiaries, only around 4,800,000 enter the donut hole.

Do Medicare Advantage Plans Cover the Donut Hole?

If there’s prescription coverage, you know there will be a coverage gap or donut hole. There is no exception to Medicare Advantage plans, and these Part C policies include a coverage gap like the standalone Part D plans.

How Can I Avoid the Donut Hole?

Avoiding the Medicare donut hole might not be possible in all cases. However, there are ways to reduce the likelihood of entering this phase.

Comparing plans yearly during the Annual Enrollment Period will ensure your policy is still the most beneficial plan is the most important thing you can do for yourself.

Next, consider using generic medications. Generic medications aren’t an option in all cases, and it’s best to consult a physician before making the switch, but talking to your doctor can save you money.

Compare the cost of your prescriptions at different pharmacies, or consider checking the cost of your drugs online. Many Part D plans have a mail-order pharmacy option that can save you quite a bit of money.

Other ways to avoid the donut hole include asking drug manufacturers about coupons and considering applying for Extra Help or the State Pharmaceutical Assistance Program.

Is there Insurance that Covers the Donut Hole?

There is no additional policy you can buy to have donut hole insurance. Avoiding the coverage gap altogether is what most people suggest. However, it can be hard to avoid the coverage gap in many cases.

If avoiding the coverage gap has been a mountain you can’t seem to climb, consider calling your prescription drug manufacturers and asking about manufacturer coupons.

Also, price-checking your drugs online to ensure you’re getting the best co-payment has proven beneficial for many people.

Will there be a Medicare donut hole in 2024?

There will be a Medicare donut hole in 2024. Once you and your insurance company have spent $5,030 on covered drugs, you’re in the coverage gap.

How Do I Get Out of the Coverage Gap?

Once your total spending on covered drugs exceeds the threshold, you’ll enter the catastrophic coverage phase and no longer be subjected to the high costs of the coverage gap.

In 2024, the total cost of spending must reach $8,000 to get out of the donut hole. That’s when catastrophic coverage automatically starts.

How to Avoid the Medicare Donut Hole

Insurance policies change annually, and the best policy for your neighbor isn’t always the best policy for you. Also, comparing your options will give you Peace of Mind.

When a licensed agent compares your meds to the formulary available, you know that the policy recommendation is the most financially beneficial based on the specific medications you take.

Plus, an agent comparing plans will estimate when you can expect to enter or exit the donut hole.

Licensed insurance agents can also help you find ways to save money by comparing the cost of your prescriptions at various pharmacies and insurance companies. Shopping with an agent saves you time and money.

We’re ready when you’re! Give us a call at the number above. Or, compare Part D plans in your area by completing our rate form.