Medicare beneficiaries can access Kansas Medicare Supplement plans, commonly called Medigap plans. When a beneficiary purchases Medigap coverage, it compensates the beneficiary for expenses that fall under the government-established benefits. Beneficiaries can extend Medicare coverage to include additional costs by purchasing a supplemental plan.

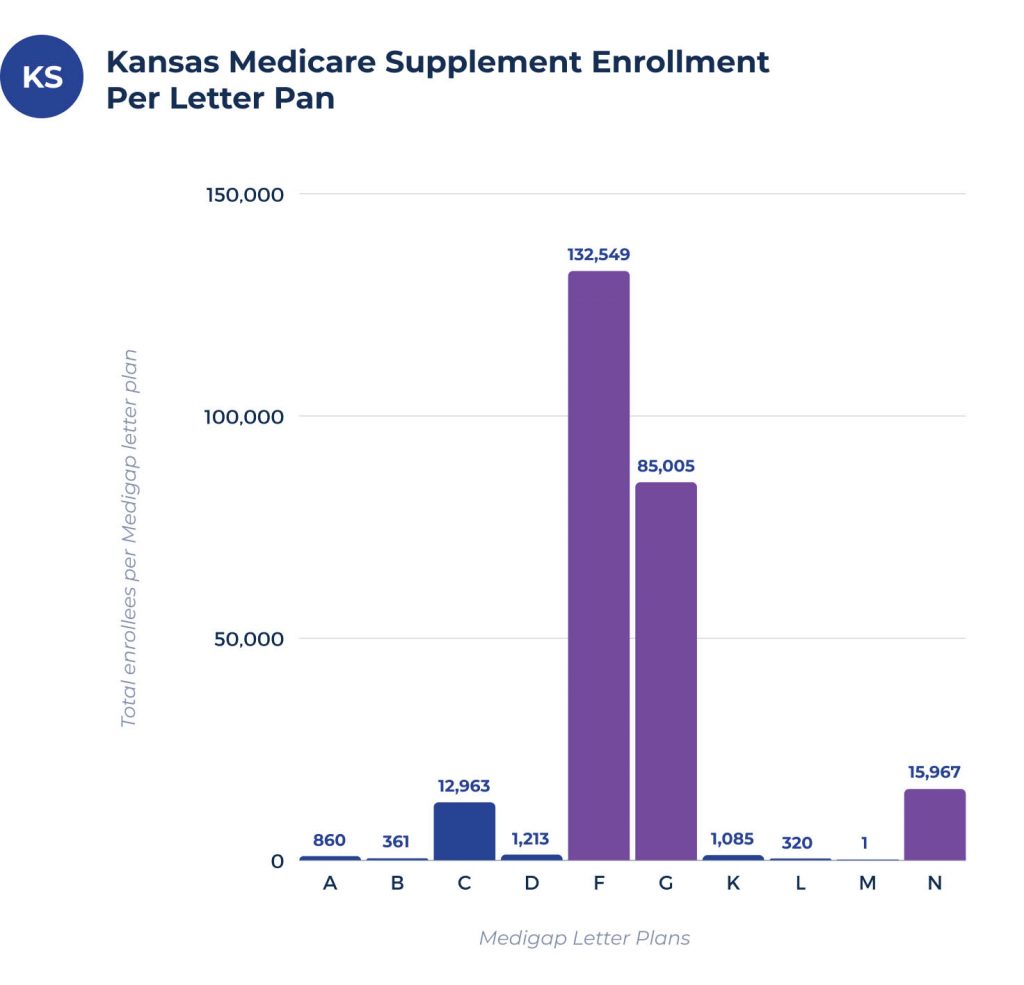

Kansas Medicare Supplement enrollment per letter plan

In Kansas, almost 250,000 people have Medigap or supplemental plans. The rate of participation in these plans in Kansas is higher than average compared to the rest of the country. Overall, 53% of beneficiaries in Kansas have this type of coverage.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 1,075 | 486 | 15,214 | 1,062 | 156,260 | 53,829 | 1,185 | 362 | 4 | 14,459 |

What are popular Medigap plans in Kansas?

Kansas Medicare Plan F is the Medigap option most beneficiaries in the state choose, with over 156,000 enrollees. It offers comprehensive coverage, which results in a positive response from enrollees.

Plan F is costly, but the premium coverage can protect beneficiaries from substantial medical bills and relieve significant stress.

Plan F remains the most common plan in the state, but Plan G is also popular with Kansas beneficiaries. Kansas residents’ second most popular choice, with over 53,000 members in the state.

Plan G provides similar coverage to Plan F with a few more gaps but at a significantly lower price point.

Plan N currently ranks third among Kansas’ most popular options. With almost 14,000 members, it offers enough benefits to attract the consideration of beneficiaries.

In addition, it provides sufficient protection at a price many residents can afford, even if it does not cover beneficiaries in as many situations as other options.

Medigap plan coverage chart for Kansas

As a result of federal standards, every Medigap plan offers the same benefits. Standardization provides beneficiaries with confidence when selecting their coverage. As a result, even if you plan to move, you’ll get the same coverage regardless of your state.

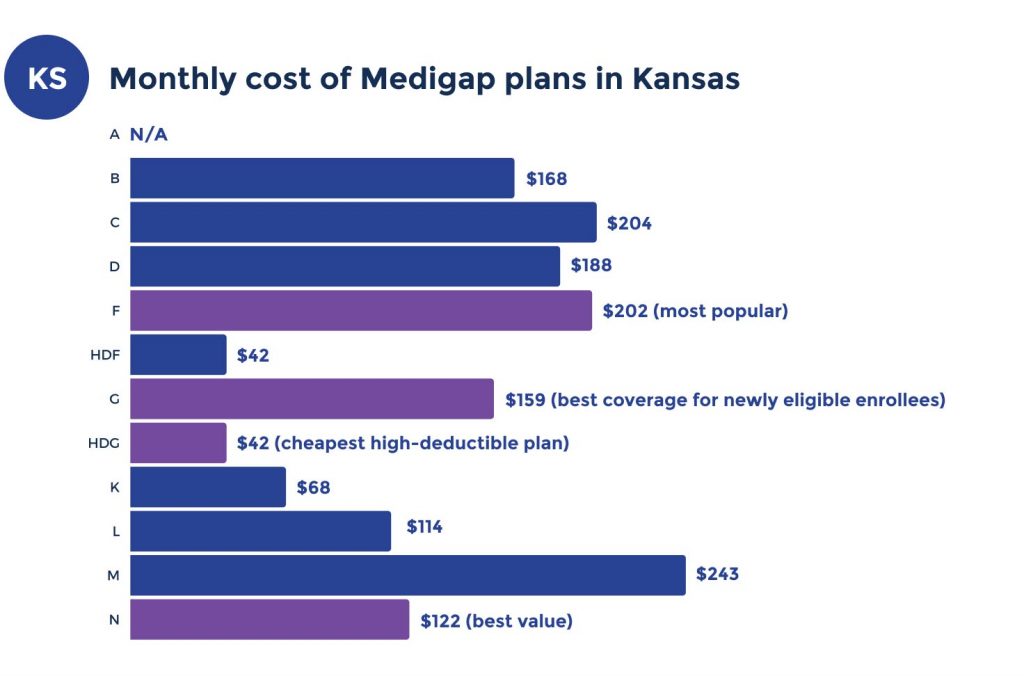

Medicare Supplement plans costs in Kansas

The premiums for Medicare Supplement plans vary depending on location, despite the programs offering the same benefits no matter where insurers sell them. Several factors determine Kansas insurance rates. Beyond medical history, other factors like frequency of drinking and smoking can also make a difference.

How much does Medigap cost in Kansas?

The average cost of a Medicare Supplement plan in Kansas is between $80 and $160 dollars a month.

Cheapest premium per Medigap letter plan in Kansas

You can find information about Medicare Supplement prices in Kansas below. We calculated these figures based on a female patient at 65 years of age, so they may not apply to your situation exactly. This information can give you a foundation of what to expect when shopping for Medigap policies.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $102 | $134 | $139 | $122 | $133 | $116 | $55 | $70 | $83 | $88 |

Most expensive premium per Medigap letter plan in Kansas

The figures in the chart below correspond to a 70-year-old male patient. As these are the most costly Medigap premiums in the state, keep in mind that your experience will differ from these numbers.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $531 | $379 | $421 | $315 | $458 | $383 | $148 | $310 | $353 | $347 |

Top Medicare Supplement plan carriers in Kansas

You can see the top Kansas Medicare Supplement plans in the table below. This chart shows the typical premiums associated with each option for a 65-year-old female patient. The final cost may vary, but it should help you understand each option’s cost.

Nassau offers the most affordable pricing for Plan F coverage at $133 per month. For beneficiaries interested in Plan N, Lumico provides the lowest price at $90 monthly.

| CARRIERS | PLAN F | PLAN G | PLAN N |

| Nassau | $133 | $117 | $93 |

| US Fire | $139 | $116 | $91 |

| Medico | $142 | $117 | $91 |

| Manhattan Life | $144 | $122 | $91 |

| Lumico | $141 | $117 | $90 |

Cities in Kansas with estimated Medicare plan premiums

Below, we’ve included charts outlining Medicare Supplement premium estimates for the following Kansas cities:

FAQs

What is the best Medicare Supplement plan in Kansas?

There are multiple Medicare Supplement plans available in Kansas. Among the providers in the state, Aetna offers the most impressive balance between cost and coverage.

With these plans, beneficiaries can protect themselves from medical expenses without excessive premiums. However, you’ll need to enroll in a Kansas Part D prescription drug plan to get your prescriptions covered.

Can I switch from Medicare Advantage to Medigap in Kansas?

You can change from Medigap to Medicare Advantage in Kansas. However, there are certain conditions to follow. Beneficiaries need to remember that they can only change their insurance coverage once a year during the Annual Election Period (AEP).

This period allows beneficiaries to alter their coverage plan each year to adjust to health or budget changes. AEP happens between October 15 and December 7, so if you’re interested in switching coverage, mark your calendar or set a reminder.

What is the birthday rule in Kansas Medicare Supplement?

The birthday rule is a piece of Kansas legislation that dictates how parental insurance policies apply to medical treatment for children. Under this rule, the parent with a birthday that falls earlier in the year will default cover the child’s treatment, which can cause issues for some families with significantly different coverage.

What do Medigap policies cover in Kansas?

Medicare Supplement plans cover expenses the consumer would otherwise have to pay out of pocket. These costs include essential treatments and ancillary aspects of coverage like vision or dental care. Before making your choice, it’s vital to research each plan letter carefully to understand how they differ from one another.

Is Medigap considered commercial insurance in Kansas?

Because the federal government supports and funds Original Medicare across the country, it isn’t a commercial insurance program. However, Medigap policies are commercial insurance because the providers behind them are private companies. These providers offer competitive benefits to attract beneficiaries in the state to their plans.

What age rating is used in Kansas?

Every insurer in Kansas uses the issue-age rating method for pricing. From lesser-known carriers like Old Surety to well-known giants like Mutual of Omaha, they all offer issue-age policies in KS.

How to sign up for Medicare Supplement plan in Kansas

Researching Medicare involves considering many costs and benefits. There are significant differences in coverage between Medicare Supplement plans.

These coverage differences impact how much you’ll need to pay if you need an operation or other treatment. Our Medigap experts can help you choose the best possible Medigap plan in Kansas.

We provide free support to all Medicare beneficiaries. We work with all providers to find the most appropriate options for each client. Call us today, or complete our online rate form to see rates in your area now.