Choosing the right state for retirement is a crucial decision that can significantly impact your quality of life, finances, and healthcare access. To help you make an informed choice, this article will explore the best states to retire in 2023, considering factors like cost of living, healthcare facilities, climate, and cultural amenities.

Factors to consider when choosing a retirement state

Several factors should be considered when selecting the perfect state for retirement. Financial considerations, healthcare quality, climate, outdoor activities, and cultural amenities play a significant role.

Financial considerations

Evaluate the cost of living in different states to align with your retirement budget. Additionally, understand the tax implications, including income tax, property tax, and sales tax, and look for states offering retirement income exemptions.

Healthcare and quality of life

Consider the availability and quality of healthcare facilities and services in prospective retirement states. Access to hospitals, medical specialists, and healthcare infrastructure is essential for a healthy retirement. Also, evaluate the climate, outdoor recreational opportunities, and cultural and social amenities for a fulfilling retirement lifestyle.

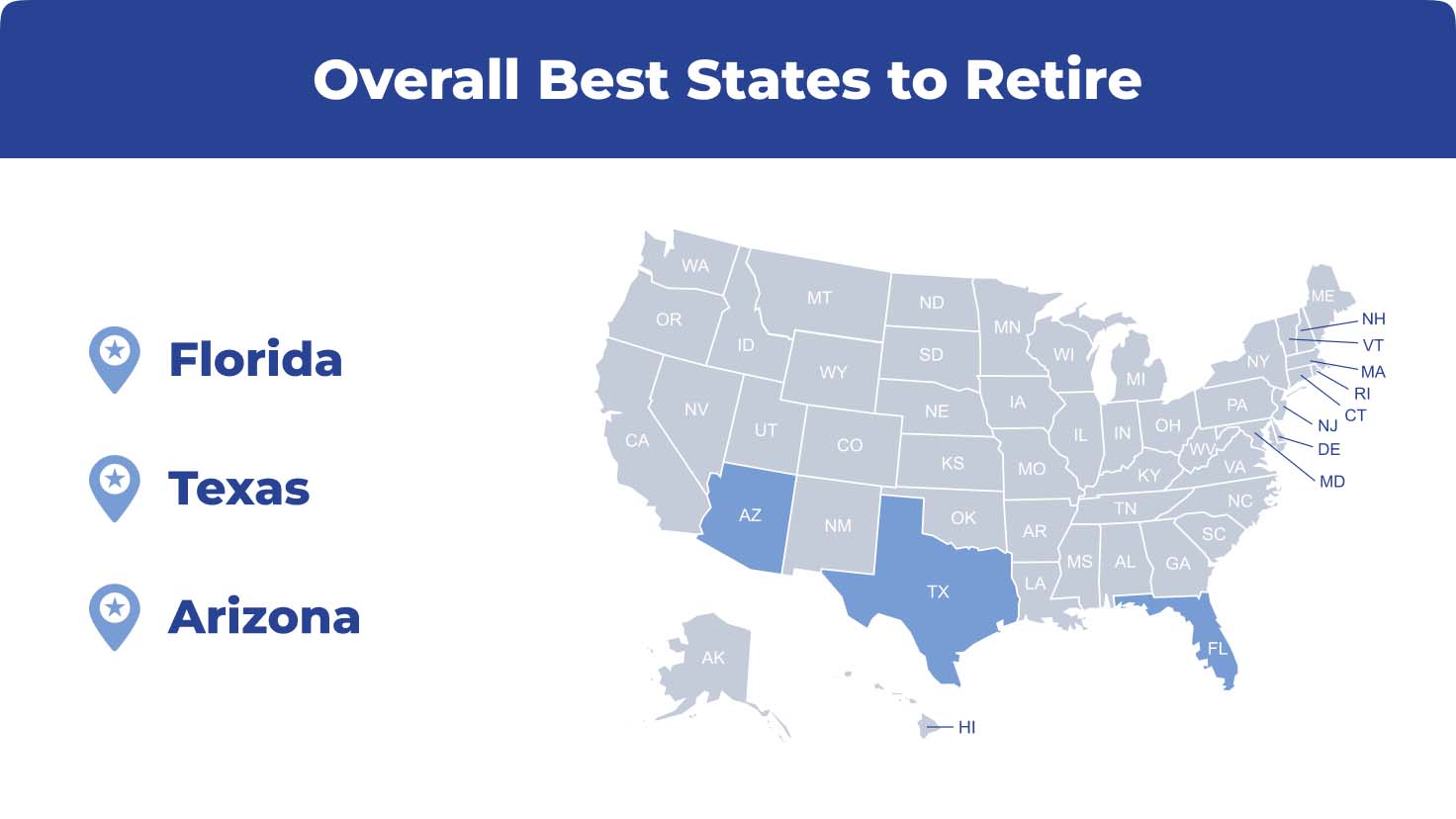

Top 3 overall retiree-friendly states in 2023

Here is our list of the overall top 3 states for retirees.

Florida

Florida is America’s top choice for retirees due to its remarkable tax benefits, including no income tax and no taxation on retirement income. The state offers an abundance of retirement communities and active adult neighborhoods, fostering a strong sense of community and social engagement. Florida’s desirable weather allows for an active outdoor lifestyle, with opportunities for activities like golfing and enjoying the beach.

Texas

Texas is the second choice for retirees, known for its robust hospital systems and excellence in cancer treatment. The state offers access to top-tier healthcare facilities and services. With no state income tax and an affordable cost of living, Texas provides a compelling financial proposition for retirees. The diverse retiree community ensures ample social interaction, and the availability of Medicare Advantage plans helps manage healthcare expenses.

Arizona

Arizona secures its position as the third choice for retirees with its diverse weather options and desirable 55+ communities. Retirees can choose a climate that suits their preferences and enjoy an active lifestyle within well-regarded retirement communities. The state also offers favorable taxation laws on property and estates, benefiting property owners. The establishment of the renowned Mayo Clinic ensures access to top-notch medical services.

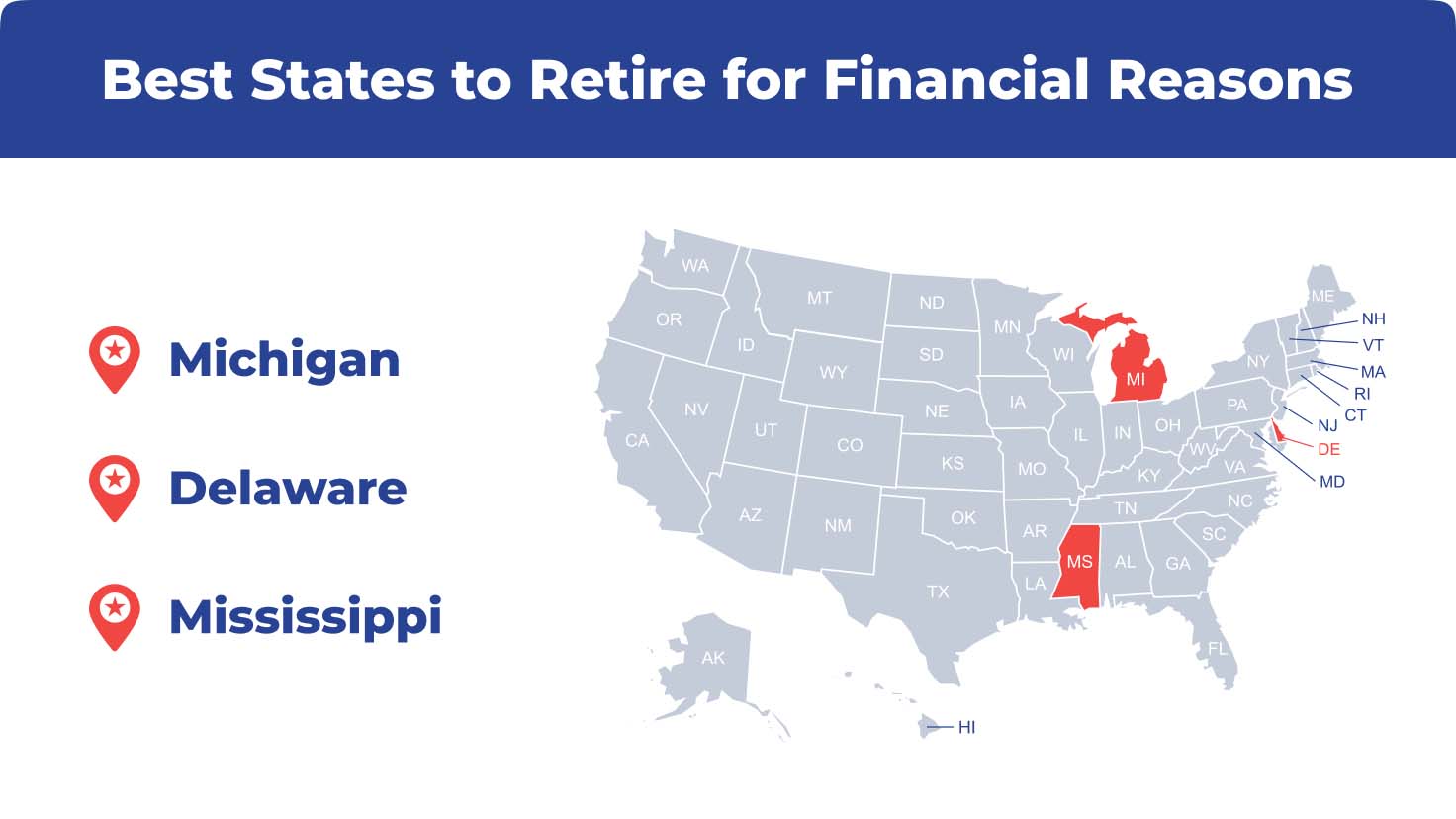

Top 3 states to retire in financially

Determining the best states to retire financially is challenging due to the individual nature of finances and expenses. Here are the top three states to retire, categorized by financial considerations, to help maximize your retirement funds.

Michigan

Michigan emerges as the top choice for retirees when considering financial factors. The state offers several financial incentives, including a relatively low state income tax rate of 4.25% which is temporarily reduced to 4.05% for 2023. Michigan also boasts a median home value of $199,100, making it one of the most affordable states for homebuyers. Additionally, it has the lowest healthcare costs in the nation and ranks second for the lowest grocery costs, making it an attractive choice for retirees.

Delaware

Delaware stands out as the leading state for retirees looking to minimize their tax burden and maximize their retirement savings. With a property tax rate of 0.57%, ranking seventh in the nation, homeowners in the state can enjoy significant tax savings compared to homeowners in other states. Delaware also offers a graduated income tax rate, providing further tax benefits.

Mississippi

Due to its affordability, Mississippi has emerged as the top choice for retirees on a fixed income. It boasts the lowest housing and third-lowest grocery costs in the United States, making it easier for retirees to cover their bills and maintain a comfortable lifestyle. The state’s other expenses, including utility bills, transportation, and healthcare, are also relatively low, providing a favorable environment for those with limited incomes.

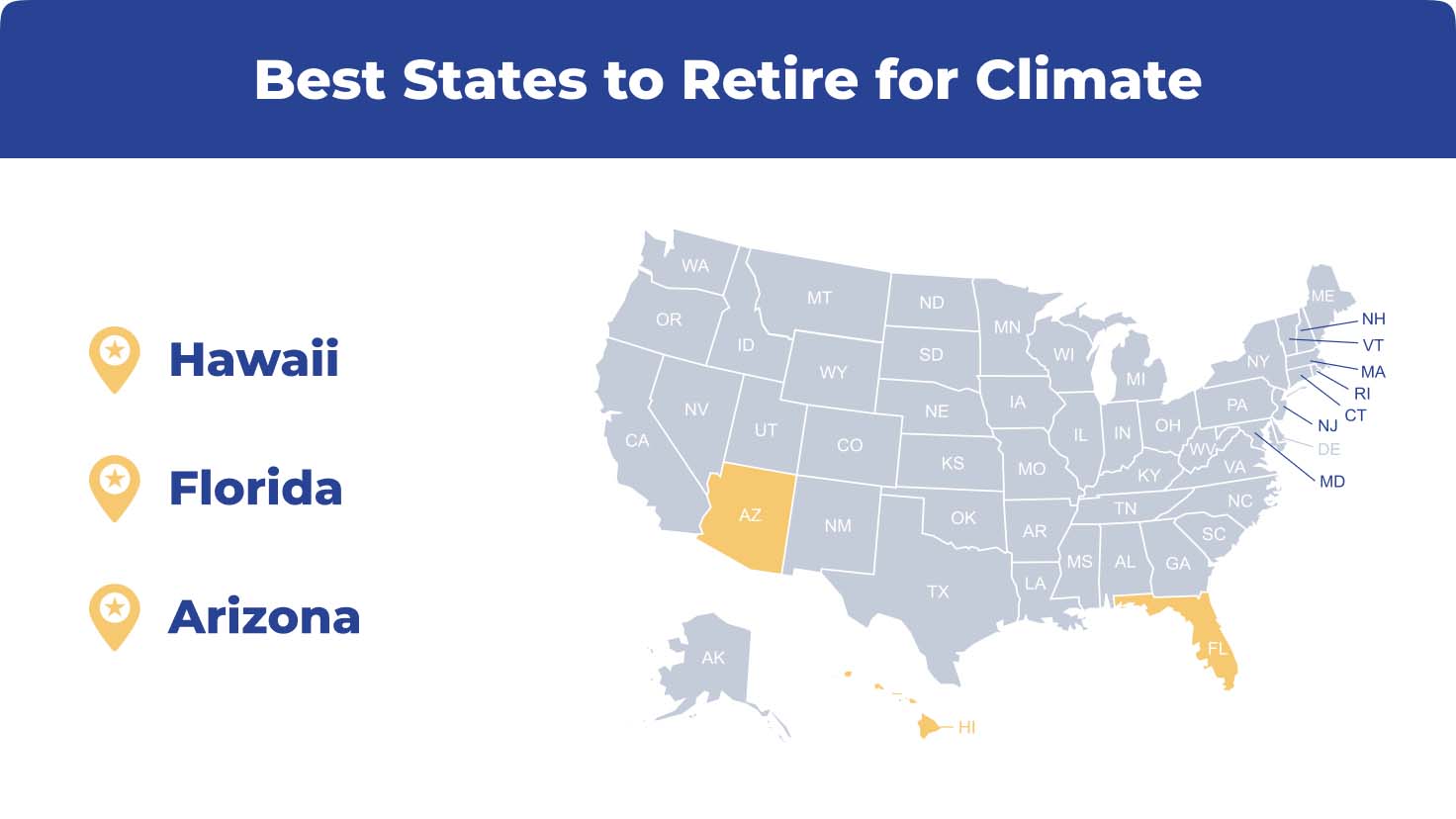

Top 3 states to retire for climate

Here are the top three states for retirement based on favorable weather conditions.

Hawaii

Hawaii is an excellent candidate for the best state for retirement weather. It offers a tropical paradise for retirees with consistently pleasant weather throughout the year and stunning natural landscapes. While there’s a potential for natural disasters like earthquakes and occasional hurricanes, Hawaii’s weather remains generally predictable.

Arizona

Arizona offers high temperatures without sweltering humidity due to its dry climate in the Mountain West. While the desert regions can be extremely hot, cooler options like Sedona and Flagstaff provide comfortable living. Arizona ranks relatively low in natural disasters and offers financial advantages such as below-average property tax rates and no state-level taxes on Social Security benefits.

Florida

Florida, known as the Sunshine State, has a subtropical climate with warm and sunny days. While it experiences significant rainfall and the risk of hurricanes, the state offers abundant sunshine and a warm climate year-round.

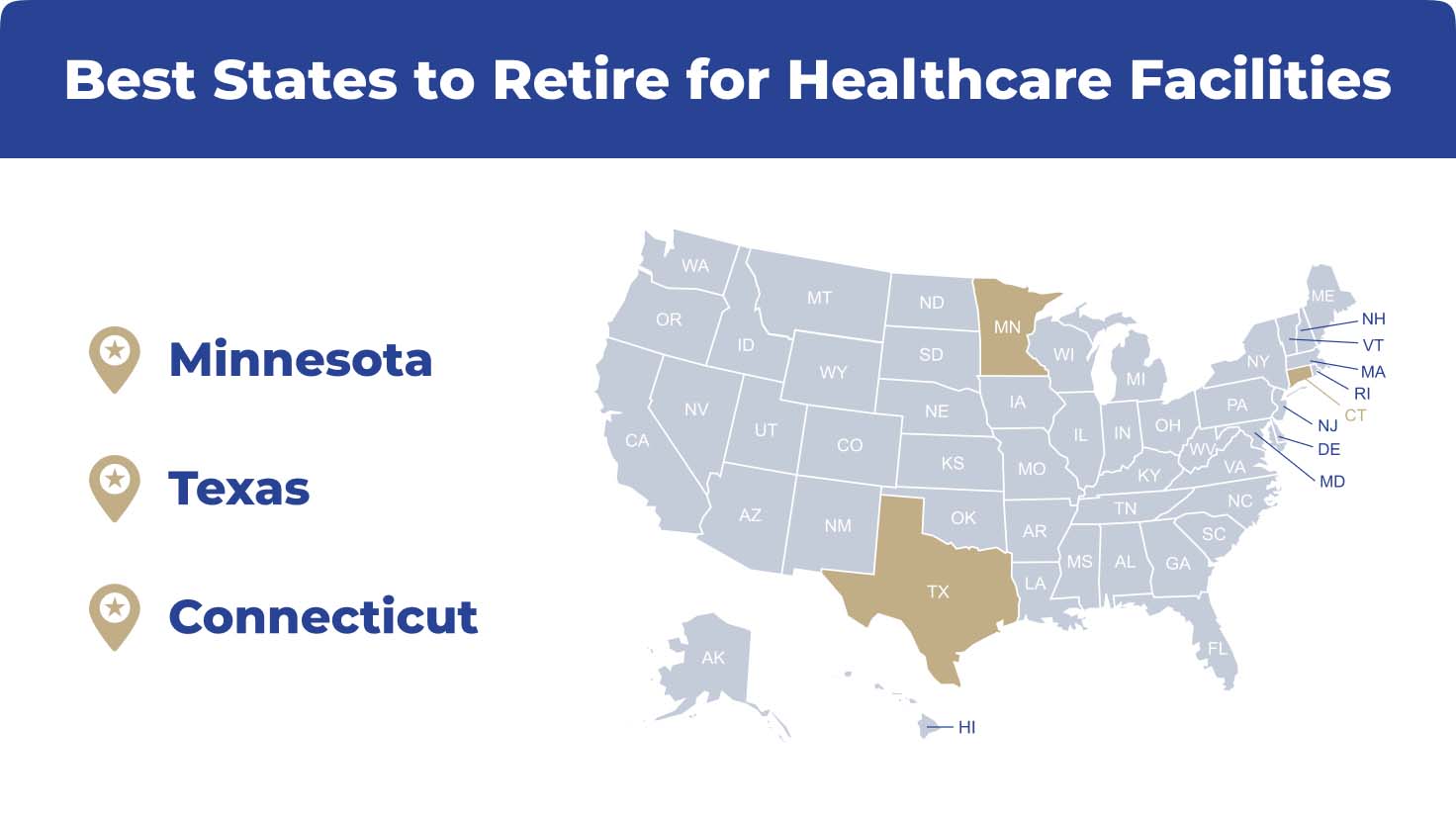

Top 3 states for retirement healthcare

Ensuring good healthcare in retirement is crucial, and it’s important to consider healthcare options when choosing a state for your golden years. The best states for retirement healthcare prioritize affordability and easy access to services. Factors such as hospital quality, coverage options, and out-of-pocket expenses significantly assess healthcare suitability for retirees.

Texas

Texas stands out as a prime choice for retirees seeking quality healthcare. With the highest number of hospitals in the country, Texans benefit from a robust healthcare infrastructure. However, the state ranks last in access to mental healthcare resources.

Minnesota

Minnesota is a top contender for retirees seeking high-quality healthcare. Despite not being the largest state, Minnesota excels in both physical and mental healthcare. Ranking 5th in the nation for mental health resources, the state ensures comprehensive care for residents. Minnesota is home to the renowned Mayo Clinic, known for exceptional healthcare services, particularly cancer treatment.

Connecticut

Connecticut remains a top choice for retirees seeking exceptional healthcare. The state boasts three 5-star hospitals providing high-quality care. Access to healthcare is readily available, and the state’s strong telehealth infrastructure facilitates virtual healthcare services. The state’s year-round enrollment for Medicare Supplement allows flexibility in switching plans without medical underwriting.

FAQs

What are the top three states for retirees in 2023?

Florida, Texas, and Arizona are the top three states to retire in 2023.

What should I consider when choosing where to retire?

When choosing a retirement state, it’s important to consider factors such as cost of living, state taxes, retirement income exemptions, healthcare facilities, climate, outdoor recreational opportunities, and cultural and social amenities.

Why is Florida a top choice for retirees?

Florida is considered a top choice for retirees due to its remarkable tax benefits, including no income tax and no taxation on retirement income. It also offers a strong sense of community, desirable weather, and abundant outdoor recreational opportunities.

Why does Texas attract so many retirees?

Texas offers robust hospital systems, attractive tax benefits (no state income tax), diverse retirement communities, and an affordable cost of living. The availability of numerous Medicare Advantage plans in Texas also helps manage healthcare expenses.

Why is Arizona a popular state for retirees?

Arizona offers a diverse climate, including warm and cooler options, appealing to different preferences. It is home to highly regarded 55+ communities, offers favorable taxation laws on property and estates, and has the renowned Mayo Clinic for healthcare services.

Finding a Medicare plan to cover you in retirement

Choosing the best state to retire in is a decision that requires careful consideration. While the states mentioned in this article offer retiree-friendly benefits, weighing your preferences and needs is essential. Review Medicare options in your area by filling out our online rate form.

Methodology:

Medigap.com extracted and analyzed data from the following to provide data in this article.

- “2021 Study: Where Americans Moved To Retire in 2021” (HireaHelper.com)

- “2022 Senior Report” (United Health Foundation)

- “Climate at a Glance Statewide Mapping” (National Centers for Environmental Information)

Related content:

- 10 Tips for Frugal Retirement Living

- Save Money and Live Better in Retirement

- Top 5 Government Benefits for Seniors Over 65

- Medicare Freebies – What You Need to Know

- Breaking the Stereotypes: Overcoming Ageism in Today’s Society