Maryland Medicare Supplement plans are a crucial element of coverage for Medicare beneficiaries. Offering a standardized set of benefits established by the government, these supplemental plans extend Medicare’s coverage to support costs that would otherwise fall to the beneficiary.

This article will cover some helpful information about Maryland Medicare Supplement plans.

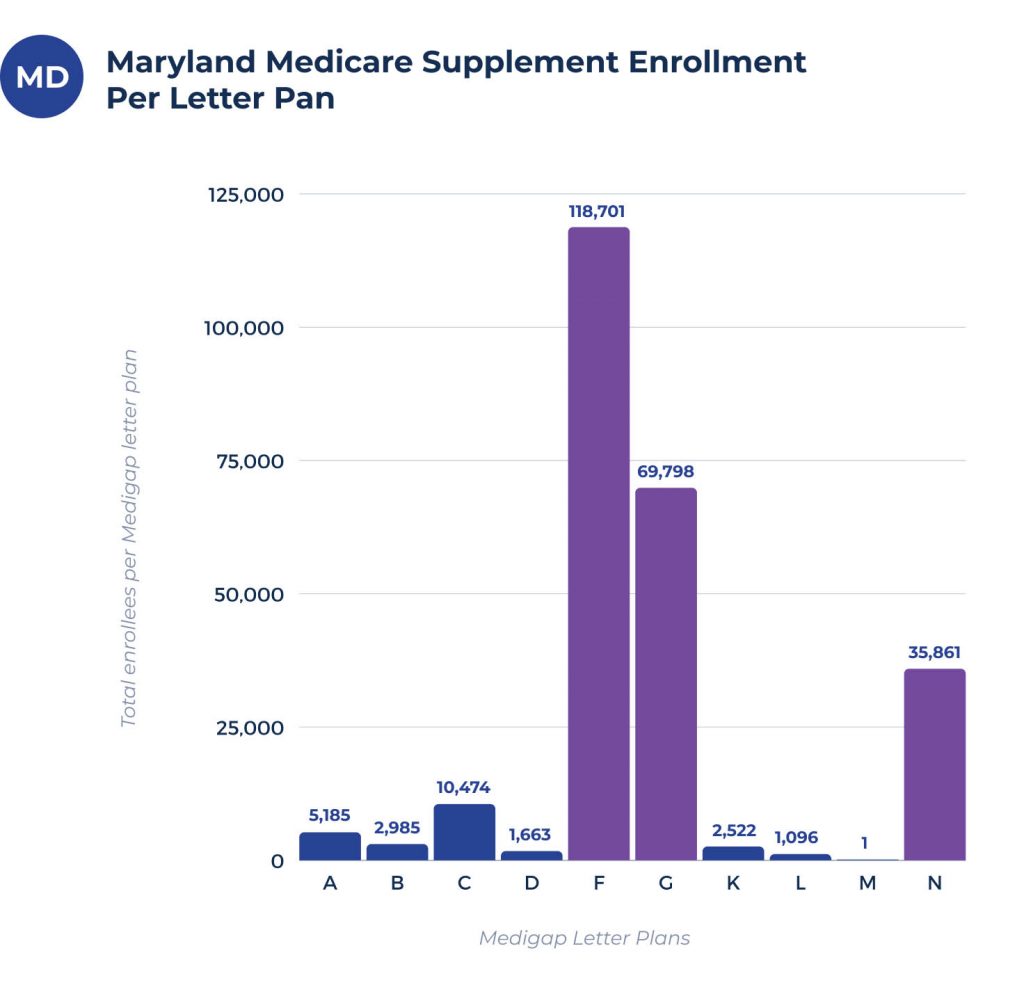

Maryland Medigap enrollment & coverage chart per letter plan

Nearly 336,000 Medicare beneficiaries currently residing in Maryland have a Medicare Supplement or Medigap plan. This number makes up around 32% of those enrolled in Medicare in the state. This rate is slightly lower than the rest of the country, demonstrating these plans’ widespread.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| 119 | 73 | 592 | 57 | 2405 | 89 | 56 | 35 | 3031 | 604 |

What are the best Medigap plans in Maryland?

The most popular plan with Maryland Medicare beneficiaries is Plan M. With over 3,000 members enrolled, this plan offers an exciting range of benefits that have earned a strong response.

Still, Plan F is another popular option. Around 2,400 Maryland residents have chosen this plan, making it an excellent second option.

Medigap plan coverage chart for Maryland

The federal government standardizes the benefits of each Medigap plan across the country. Standardization means that the same benefits will be available regardless of your state, so you can confidently choose a plan even if you plan on moving.

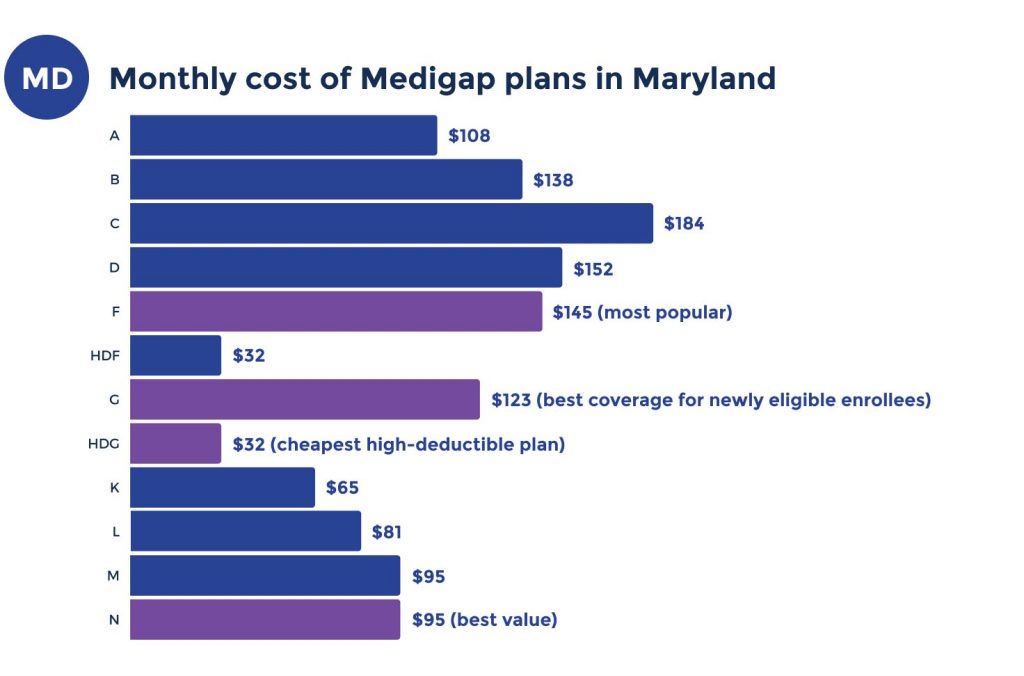

Medicare Supplement plans costs in Maryland

Although the benefits of Medicare Supplement plans remain consistent regardless of location, the premiums’ cost varies. The premiums in Maryland may be lower or higher based on several determining factors. These factors include medical history and lifestyle choices such as tobacco and alcohol use.

How much does Medigap cost in Maryland?

The standard premium cost of Medigap plans in Maryland during is runs from $95 to $180 per month. Premium costs may fluctuate depending on the insurer and the rating of your premium.

Inexpensive premium per Medigap letter plan in Maryland

The chart below contains some figures to give you an idea of Medicare Supplement costs in Maryland. The numbers represent a 65-year-old female patient, so don’t expect them to be exact. Still, these figures can give you an idea of what to expect when signing up for Medigap coverage.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $108 | $137 | $166 | $150 | $135 | $115 | $61 | $80 | $94 | $96 |

Most expensive premium per Medigap letter plan in Maryland

The figures in the chart below simulate a 70-year-old male patient. This chart represents the higher end of the spectrum of Medigap premium pricing.

| PLAN | A | B | C | D | F | G | K | L | M | N |

| Premium | $1,631 | $451 | $631 | $268 | $505 | $452 | $173 | $324 | $493 | $431 |

Top Medicare Supplement plan carriers in Maryland

The chart below presents the top Medicare Supplement plan carriers for Maryland beneficiaries. The information represents a 70-year-old female patient, so costs may vary, but the chart should give a good idea of what to expect with each option.

| CARRIERS | PLAN F | PLAN G | PLAN N |

| Physicians Life | $146 | $124 | N/A |

| Royal Arcanum | $156 | $136 | $107 |

| Slbi Life | $157 | $130 | $104 |

| Aetna | $167 | $153 | $110 |

| Accendo | $171 | $160 | $124 |

Cities in Maryland with estimated premiums for Medicare Supplement coverage

There are charts with estimated premiums for Medicare Supplement coverage for the below cities:

FAQs

How much does Medigap cost in Maryland?

The standard premium cost of Medigap plans in Maryland during is runs from $95 to $180 per month. Premium costs may fluctuate depending on the insurer and your premium rating.

How do Medicare Supplement plans work for the state of Maryland retirees?

Retirees in Maryland are eligible for benefits under Medigap plans. These benefits may differ from those available to active employees.

What is the most basic Medicare Supplement plan in Maryland?

For basic and comprehensive supplemental Medicare coverage in Maryland, Plan G is an excellent option. This plan covers many medical expenses, with beneficiaries still responsible for Plan B deductible. However, while Plan G offers excellent basic coverage, it can be too expensive for some consumers.

What are the three ways Medicare Supplement plans are rated in Maryland?

Maryland Medicare Supplement plans to establish rates in three different ways. First, community-rated plans offer a set rate for all enrolled beneficiaries, balancing the cost burden evenly among everyone enrolled.

The other two types are both based on age, with entry age-rated plans depending on your age when you enrolled. Conversely, age-attained rated plans will change their prices as you age, making this the most individualized style of rate setting.

Can I switch from Medigap to Medicare Advantage in Maryland?

Switching from Medigap to Medicare Advantage in Maryland is possible, but there are limitations. You can only switch coverage once yearly; the change must occur during the Annual Election Period or AEP. This period is from October 15 to December 7, so plan if you want to switch coverage.

How to sign up for a Medicare Supplement/Medigap plan in Maryland

Navigating the Medicare system can be overwhelming, considering many factors and options. Choosing the right Medicare Supplement plan is crucial, as the differences in coverage can significantly impact the costs you’re responsible for when things go wrong.

If you’re struggling to choose the right Maryland Medicare Supplement plan, we’re here to help. Our experts can help make the process simple. Call or fill out the online form on our website to get rates for your area today.